In today's fast-paced business environment, having a solid merchant account solution is essential for success. Whether you run a brick-and-mortar store or operate an e-commerce platform, the ability to process payments securely is a fundamental aspect of your business. Proper planning for merchant account solutionsis crucial to streamline operations, reduce costs, and provide a seamless experience for your customers.

What Is A Merchant Account?

It is possible to take credit or debit card payments using a merchant account, a bank account that also formally creates a connection between you and your preferred merchant services provider.

When a company has a merchant account, it effectively serves as a temporary holder for monies that have been transacted using credit or debit cards. Following the transaction, the issuing bank, also known as the bank of the cardholder, delivers the money to the merchant account, which deposits it into your preferred business account.

That's accurate. Your principal business account is not your merchant account, and you cannot consolidate these accounts. You must set up a standard business account before you even attempt to register for a merchant account.

What else you need will be discussed later. As a mutually agreed-upon bay where transactions are stored and appropriate fees are collected by each separate entity (issuing bank, MSP, etc.), merchant accounts serve this purpose.

All parties involved see a reduction in risk as a result, and more complex party integrations are made possible. Your choice of frequency (monthly, every other week, etc.) and length (from provider to provider) for these financial transfers typically applies.

Who Needs A Merchant Account

A merchant account is required by the majority of companies that take credit and debit card payments electronically. This covers companies of all sorts, from modest home-based operations to enormous conglomerates.

Following are a few instances of companies that generally need a merchant account or access to merchant services via their payment processing provider:

E-Commerce Businesses

To handle payments from clients who buy items from their websites, online businesses require a merchant account.

Restaurants

To accept credit and debit card payments from clients who eat in or make takeout orders, whether those orders are placed in person, online, or via mobile applications, restaurants, and other food service enterprises require a merchant account.

Healthcare Providers

For processing payments from clients who use their insurance card or credit card to pay for services, healthcare professionals like physicians and dentists require a merchant account.

Retail Stores

To accept payments from consumers using credit or debit cards to make in-store purchases, retail shops must have a merchant account.

Service-Based Businesses

Businesses that provide services, such as consulting companies, need a merchant account to accept payments from customers who use credit or debit cards to pay for those services.

Nonprofit Organizations

To accept donations from supporters who make contributions using credit or debit cards in person or online, nonprofit organizations must have a merchant account.

According to the provider and the kind of business, there may be different criteria for obtaining a merchant account. It's crucial to thoroughly investigate all of your alternatives to choose the best merchant account for your company.

How Merchant Accounts Work

For the majority of businesses, merchant accounts are an essential part of daily operations. Transaction charges are a significant factor for merchants to consider when selecting the finest business bank for a merchant account. Merchant Acquirers, who work with merchants to enable electronic payments, provide merchant accounts.

The establishment of a merchant account is only sometimes necessary for physical-and-mortar businesses that only take cash payments; instead, they may depend on a straightforward deposit account at any bank. However, because clients can only make purchases via electronic payments, online firms must set up merchant account partnerships as a part of their company operations.

Merchant Account Fees And Rates

Each credit card processor levies a fee depending on the amount of transactions. This is often a fixed sum for each transaction, but it may also be a percentage of the purchase price. Transaction fees may be as much as 30 cents for each transaction plus 0.5% to 5% of the purchase price.

Specific credit card processors often charge a monthly fee, and this price covers customer support, statements, and sometimes more sophisticated software or security measures like PCI compliance (a security requirement). When chargebacks occur, additional costs are charged.

You should definitely purchase card processing equipment like a mobile card reader, fixed card reader, or point-of-sale (POS) system if you operate an in-person company like a shop, restaurant, or food truck. These must be bought, while some credit card processors provide exclusive offers to new businesses that waive or significantly lower the cost of a fundamental card reader.

Learn What Kind Of Merchant Services You Want

Deciding on the services your company needs is the first step in opening a merchant account. Remember that using merchant account services is primarily intended to accept credit and debit card payments rather than relying on cash transactions.

However, the ideal merchant services provider will provide your company with all the tools and payment choices it needs to go even further. Additionally, it helps your organization provide a superior level of client service while also making financial savings.

In-Person Payments

It is a brilliant idea to use a traditional point of sale (POS) terminal if you own a physical and mortar business. By synchronizing with the merchant software on your register, POS terminals can process payments.

Mobile Payments

Use mobile payment processing solutions if you need a portable setup. To process card payments remotely, you may use these wireless contemporary card readers that you can connect to your iOS or Android smartphones. (Square readers are a typical illustration of a mobile card reader.

There's a good possibility that you've seen a Square reader if you've visited a food truck.) You should check to see whether you can accept payments via digital wallets like PayPal, Venmo, or Apple Pay in addition to just credit card payments on a mobile reader.

E-Commerce Payments

On the other hand, if you run an online company, join a merchant account provider that offers you a payment gateway. This enables you to take online payments over the web and have your merchant services provider deposit the money into your bank account.

Over-The-Phone Payments

This is similar to how you may register for a virtual terminal to manually input a customer's credit card information into your system if you handle payments over the phone.

You should acquire the appropriate payment processing equipment required to accept your chosen credit card payment types depending on the sort of merchant services you wish to set up. This equipment has various prices attached to it and is purchased directly from your acquiring bank or merchant services provider.

When it comes to online payments, this takes the form of software and payment gateway assistance, both of which come with a service charge.

How To Open A Merchant Account

You must register a merchant account if you want to start taking credit card payments from your consumers. Even while the procedure can seem complicated at first, it's really not. To open a merchant account and get going, follow these 7 steps.

Get A Business License

You must demonstrate the legitimacy of your firm in order to obtain a merchant account. Obtaining a current business license is the first step.

Open A Business Bank Account

You'll need a business bank account after you get a business license. Your merchant account provider will deposit your credit card sales and deduct any fees into this bank account. The majority of companies choose to create a business bank account with a local bank because these institutions often provide a degree of convenience and customer care that Internet accounts cannot match.

You'll need to supply your EIN (employment identification number) and business license in order to open a business bank account.

Evaluate Your Needs

Before you create a merchant account, consider what your company needs. You must choose which credit cards you wish to handle, for instance. Do you take Mastercard and Visa just, or also American Express? What about eChecks or ACH?

The next thing you must decide is how you will take credit card payments. Do you only need a physical solution to handle payments in your brick-and-mortar business? Or do you need a system that accepts both online and mobile payments? Will you provide a customer payment gateway where consumers may settle their invoices? How will your clients pay you?

Draw out a detailed list of all the requirements your company will have, both now and in the future. Be careful to account for them in your planning if you want to grow over the coming years and anticipate needing more money in the future.

Compare Providers

With a better understanding of your company's requirements, you can start comparing merchant account providers to find the best match.

Complete An Application To Open Your Merchant Account

You must complete an application after comparing merchant account providers and selecting one. Detailed information about your company will be required for this application, so be ready with any required paperwork. Most likely, you'll need to supply:

- Business start date

- Contact information

- Authorized signer information (the person who is authorized to withdraw or spend money from the account)

- Bank account and routing numbers

- Tax ID

- Estimated processing volume in dollars

You'll need to supply more or less information depending on the volume you anticipate processing. A small firm that anticipates processing several thousand dollars per month may be required to provide a canceled check and evidence that they are presently engaged in the legal business. A more prominent company, on the other hand, could be required to provide bank statements dating back many years.

Submit To Underwriting

Both the supplier of the account and the acquiring bank run a risk when they accept a merchant account. As a result, the supplier will examine and evaluate your company before admitting you. They are on the lookout for warning indications, such as high-risk enterprises or sectors, fraud indicators, or newly established businesses.

If your company is established and has shown sound financial standing for at least a few months to a year, you should have no trouble getting through the underwriting procedure. However, given that banks and account providers are less willing to accept the risk of a new firm, it may be difficult for startups to go beyond the underwriting step.

Get Your Merchant Account Approved And Start Processing

Opening a merchant account may take anything from one business day to around a week, depending on the supplier. Once your firm has been authorized, you may immediately begin receiving credit card payments from your clients.

Importance Of Proper Planning For Merchant Account Solutions

Proper planning for merchant account solutions is of paramount importance for businesses of all sizes and types. The right merchant account solution can significantly impact a company's bottom line, customer satisfaction, and long-term success. Here's a more in-depth look at why proper planning for merchant account solutions is crucial;

Cost Optimization

Effective planning allows businesses to choose a merchant account solution that aligns with their specific needs, which can result in cost savings. Selecting the correct type of account, with features and services that are necessary for your business, can lead to higher fees and operational costs.

Enhanced Customer Experience

A well-planned merchant account solution enables seamless and secure payment processing, creating a positive experience for customers. Easy and efficient transactions can lead to higher customer satisfaction and repeat business.

Security And Trust

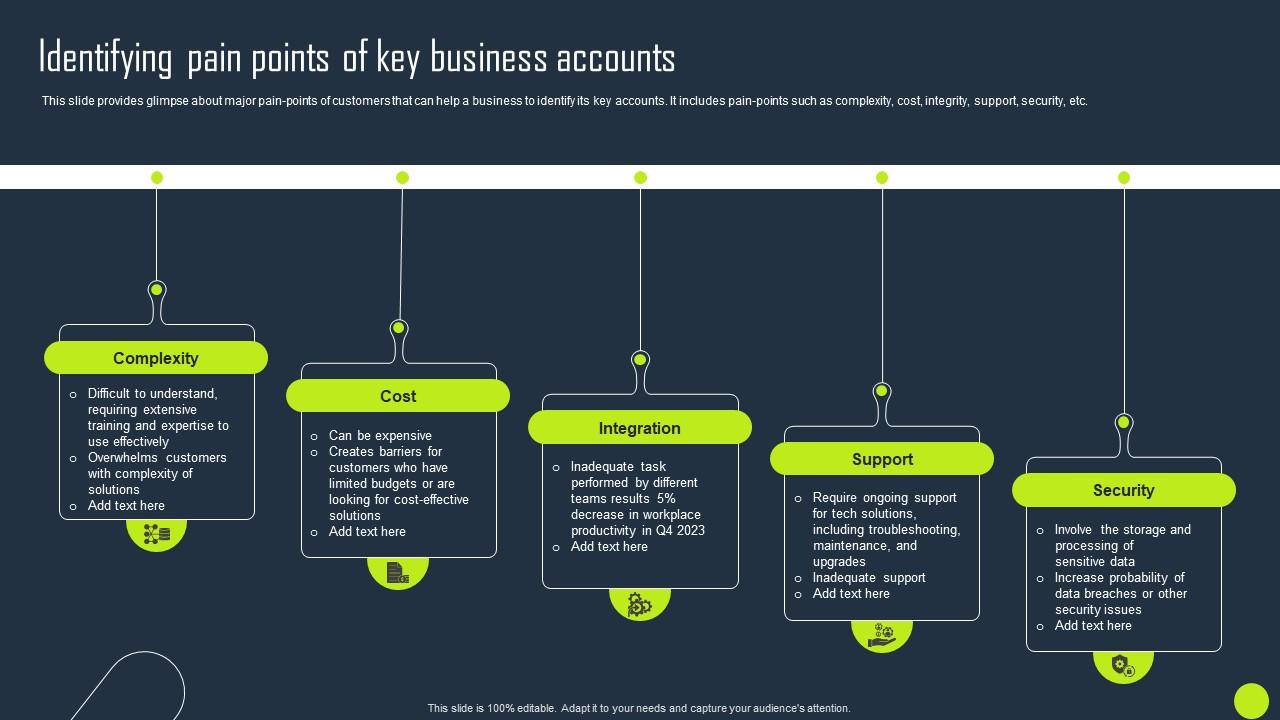

Proper planning ensures that your business complies with industry-standard security protocols like PCI DSS, which protects sensitive customer data. The trust and reputation you build by securely handling transactions can translate into a competitive advantage.

Flexibility And Scalability

Effective planning allows businesses to choose a solution that can adapt to their changing needs. This scalability is essential for growth and expansion. It ensures that your payment processing can keep up with increasing transaction volumes and evolving business models.

Risk Mitigation:

Planning helps businesses identify and address potential risks associated with payment processing, such as fraud and chargebacks. Understanding these risks and taking appropriate measures can save a company from significant financial losses.

Compliance And Legal Requirements

Different industries and regions may have specific legal and compliance requirements regarding payment processing. Proper planning ensures that your merchant account solution complies with all relevant regulations, reducing the risk of legal issues and penalties.

Operational Efficiency

Well-planned merchant account solutions are integrated seamlessly into a business's operations, reducing manual work and streamlining processes. This efficiency can save time and resources, allowing employees to focus on other essential tasks.

International Expansion

For businesses looking to expand internationally, careful planning is essential. Different countries may have unique payment methods, currency considerations, and regulatory requirements. The right merchant account solution can facilitate international growth.

Technical Compatibility

Compatibility with your existing systems, whether it's an online store, point-of-sale (POS) terminals, or mobile devices, is vital. Planning ensures that your chosen solution integrates smoothly with your current technology stack, reducing friction in operations.

Customer Support And Issue Resolution

When problems arise, quick and effective issue resolution is crucial. Proper planning includes assessing the level of customer support offered by your merchant account provider, which can prevent prolonged downtime and customer frustration.

Competitive Advantage

A well-thought-out merchant account solution can give your business a competitive edge. When customers see that you offer secure and convenient payment options, they are more likely to choose your company over competitors.

Data Analysis And Insights

Many modern merchant account solutions come with data analytics tools that provide valuable insights into customer behavior and transaction patterns. Proper planning can ensure that you have access to these tools, which can inform strategic decisions and marketing efforts.

Marketing And Customer Retention

Your merchant account solution can be a powerful tool for customer retention. For instance, you can implement loyalty programs and special promotions that rely on payment data. Effective planning enables you to harness this potential.

Proper Planning For Merchant Account Solutions - FAQs

What Are The Key Factors To Consider When Selecting A Merchant Account Solution?

When selecting a merchant account solution, it's crucial to consider factors such as the type of business you run, preferred payment methods, transaction volume, security features, and integration options.

How Can The Wrong Merchant Account Solution Impact My Business Financially?

Selecting the wrong merchant account can lead to higher fees, unnecessary expenses, and reduced profitability.

Why Is Security And Compliance A Top Priority In Merchant Account Planning?

Security and compliance are vital in merchant account planning because they protect sensitive customer data, maintain trust, and reduce the risk of data breaches or legal consequences.

What Role Does Scalability Play In Proper Merchant Account Planning?

Scalability is crucial in merchant account planning because it allows your business to adapt to changing transaction volumes and evolving needs. A scalable solution ensures that payment processing can grow with your business, preventing disruptions and inefficiencies.

Conclusion

Proper planning for merchant account solutions is a critical step in ensuring the success and growth of your business. It involves a thorough evaluation of your business needs, research into providers, and an understanding of fees, security, and compliance.

By making well-informed decisions and selecting the right merchant account solution, you can streamline payment processing, enhance customer trust, and position your business for long-term success. Remember that the right merchant account solution isn't just a financial transaction; it's an investment in the future of your business.